Purchasing a home in New York City is a major financial commitment that involves more than the listed price.

One key aspect to remember when planning to buy a home is how much are closing costs in NY, which can add up to a substantial amount. These costs are often overlooked but are a critical part of the home-buying process to finally get the key to your dream home!

It is important to factor in these expenses to avoid any surprises. Understanding and budgeting for closing costs can help ensure a smooth transition into your newly purchased property!

What are Closing Cost

Closing costs refer to various expenses and fees homebuyers and sellers must pay when finalizing a real estate transaction. They usually cover the different services required to complete the purchase of a home.

You usually pay for closing costs at the final step of the home-buying process, or what we call ‘closing.’

Closing costs can be expensive, especially for higher-priced homes. That’s why it is important to have an idea of what closing costs are in NY in particular so you can estimate and prepare your finances.

Average Closing Costs in NY

So, how much are closing costs in NY, exactly? Well, they vary but typically range between 2% and 5% of a home’s purchase price.

New York has some of the highest closing costs in the country. That being said, the average closing cost for a home loan of $352,314 is $8,256, or 2.34% of the loan amount. This makes New York the most expensive state for closing costs, second only to Washington, D.C., where the average closing cost is $13,722 (2.41% of a $568,535 loan).

As of January 2025, Zillow reports New York’s median home value at $763,861, meaning buyers can expect closing costs between approximately $15,277 and $38,193.

Who Pays Closing Costs in NY?

In New York City, buyers and sellers must cover certain closing costs when completing a real estate transaction. Depending on the deal’s specifics, these costs can vary, but understanding who is responsible for which fees can help manage expectations and prepare for the financial commitment.

But how much are closing costs in NY for buyers? The closing costs you are responsible for usually depend on the agreement with the seller but expect to pay between 2% and 5% of the purchase price. Closing costs of buyers typically include loan-related fees.

Here is a breakdown of the closing costs buyers in NY can expect to pay.

1. Mortgage Application Fee

A lender charges This one-time fee when you apply for a mortgage. The amount can vary significantly between lenders, so it’s important to compare options to find the best fit for your financial situation.

Typically, this fee is nonrefundable, meaning you won’t get the money back if your loan application is denied.

2. Loan Origination Fee

This is the fee charged by the lender for processing your loan. It typically amounts to about 0.5-1% of the loan amount, but the exact fee will vary based on various factors such as type of mortgage, your credit score, and the loan size.

3. Appraisal Fee

An appraisal fee is the cost of hiring a licensed appraiser to evaluate the home’s value before your lender approves the loan. This process ensures the property’s value aligns with the loan amount. Appraisals typically range from $300 to $500 and are paid when the service is rendered.

4. Survey Fee

A property survey confirms the boundaries of the land you buy and identifies legal property limits. This is especially important if you plan to build or make significant changes or renovations to the property. Survey fees in NY are around $375.

5. Title Insurance

A one-time fee that protects you against potential issues with the property’s title, including mistakes in public records, undisclosed liens, or fraud.

The cost of title insurance often ranges between 0.5% to 1% of the property’s purchase price. This coverage ensures that you’re financially protected if any legal complications arise related to the title after the sale.

It’s essential to securing peace of mind throughout the home-buying process.

6. Homeowner’s Insurance

If you’re financing your residential property with a mortgage, your lender will typically require you to purchase homeowner’s insurance to protect the property by covering potential damages. In some cases, it may be bundled with other costs, such as property taxes, if an escrow account is set up.

The first year’s premium must generally be paid before or during closing. This payment can be made directly, or if you have an escrow account, it may be included as part of your monthly payments.

7. Mortgage Insurance

This fee protects the lender if you are unable to repay your loan. It is typically required for loans with less than 20% down payment. The annual cost usually ranges between 0.5% and 1% of the loan amount.

8. Recording Fees

These are fees paid to the local government to officially record and document the sale of the property and put it into public records. Recording fees typically cost $32, with an additional $5 charged for each extra page.

9. Prepaid Escrow

This initial deposit is made into an escrow account, which covers future property taxes and homeowner’s insurance premiums. The amount of this deposit varies based on the lender’s requirements and the estimated amounts for taxes and insurance.

Seller Closing Costs in New York

Now that we understand buyers’ costs, let’s now talk about how much are seller closing costs in NY. Sellers in New York usually have closing costs between 6–10% of the home’s sale price.

Here’s a breakdown of the typical costs that sellers pay.

1. Real Estate Broker Commission

Sellers also pay commissions to real estate agents, who help throughout the process of selling the property. This fee typically amounts to around 6% of the sale price, with 3% allocated to the seller’s agent and 3% to the buyer’s agent.

However, this percentage is open to negotiation and can vary based on the terms agreed upon by the seller and the agents involved.

2. Settlement Fee

This fee ensures that all necessary documents are properly prepared, facilitates communication between the buyer and seller, and handles the transfer of ownership.

This fee may also include additional charges, such as loan origination, credit report, lender appraisal fees, property taxes due at closing, and the recording fees required to officially register the sale with local authorities.

3. Title Insurance

The seller pays another one-time fee at closing to protect the buyer and lender from financial loss resulting from issues with the property’s ownership history, like liens or disputes over ownership.

The coverage remains valid if the insured party owns the property or holds a financial interest.

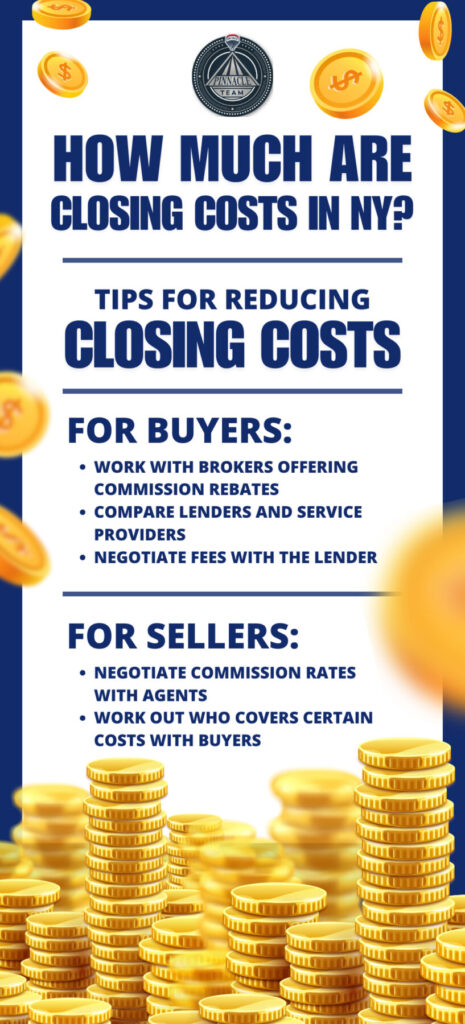

Strategies to Lower Closing Costs For Buyers

Work with a Broker Offering a Commission Rebate

Some brokers in New York offer commission rebates, which can help offset closing costs. Since not all brokers provide this benefit, it’s wise to shop around and ask about potential rebates before selecting an agent.

Compare Lenders and Service Providers

Mortgage rates and fees vary by lender, so it’s essential to get multiple loan estimates to secure the best deal.

Additionally, compare prices for other services such as attorney fees, title insurance, and home inspections, as costs can differ depending on the provider.

Negotiate with the Lender

Some lenders may be willing to lower specific fees, such as loan origination or application fees.

Strategies to Lower Closing Costs For Sellers

Negotiate the Real Estate Commission

One of the highest seller costs is the commission paid to real estate agents. It is recommended that multiple agents be interviewed and their services compared.

When agents know they are competing for your business, they may offer lower commission rates or include additional services at no extra charge.

Negotiate with the Buyer

In some cases, you may be able to negotiate with the buyer to cover certain closing costs, like title insurance or transfer taxes. This can reduce the amount you must pay at closing and make your sale more cost-effective.

Comparing NY Closing Costs to Other States

New York ranks among the states with the highest closing costs in the country, alongside Washington, D.C., Delaware, Maryland, and Washington. These high costs are driven by expensive homeowners insurance premiums and property taxes, which add to the overall expense of purchasing a home.

Here’s a comparison of New York’s closing cost to other nearby states based on the average home price in 2024.

| State | Average Home Price | Average Total Closing Cost with taxes | Average Total Closing Cost without taxes |

|---|---|---|---|

| New York | $538,102 | $16,849 | $6,168 |

| New Jersey | $461,488 | $7,915 | $4,158 |

| Pennsylvania | $248,561 | $10,634 | $4,221 |

| Connecticut | $419,149 | $8,851 | $4,108 |

| Massachusetts | $604,986 | $7,964 | $4,904 |

Conclusion

Closing costs are a crucial yet often overlooked expense in home-buying and selling, especially in a high-cost market like New York.

With costs ranging from 2% to 5% of a home’s purchase price for buyers and 6% to 10% for sellers, these expenses can add up quickly!

Understanding the breakdown of these expenses and planning ensures a smoother transaction and helps buyers and sellers make informed decisions in New York’s competitive real estate market.

If you’re ready to take the next step in your real estate journey or have any questions about closing costs, don’t hesitate to contact us and get a clear estimate. You may reach our team by calling 718-873-6144. Start planning today to ensure a seamless and financially sound home-buying or selling experience!

Frequently Asked Questions

Can closing costs be rolled into the mortgage?

Yes! Closing costs can be rolled into the mortgage in some cases, but this depends on the lender and loan type. However, rolling closing costs into the loan increases the interest rate of your mortgage, thus raising the total loan amount.

Are closing costs tax-deductible?

Certain closing costs may be tax-deductible, but not all. Typically, deductible costs include property taxes, mortgage interest, and points paid to lower your interest rate. However, other fees like title insurance and appraisal costs are not deductible.

It’s best to consult a tax professional to determine what applies to your situation.

What’s the Mansion Tax in NY?

New York’s Mansion Tax is a one-time tax on residential properties valued at $1 million or more. The tax rate is around 1-3.9%, depending on the property’s value. The buyer usually pays this tax at closing.

Can sellers negotiate who pays closing costs?

Yes, closing costs can be negotiated between buyers and sellers. In some cases, sellers can ask the buyer to pay for some expenses or may agree to cover part of the buyer’s closing costs as an incentive to close the deal.

However, this depends on the market conditions and the negotiation between both parties.

What is included in the Closing Disclosure?

The Closing Disclosure is a crucial document for buyers at least three days before closing. It outlines all the final loan terms, interest rates, monthly payments, and itemized closing costs.

Getting and reviewing this document ensures that there are no unexpected fees or discrepancies before finalizing the purchase.